Outline and Annotated Bibliography

Outline and Annotated Bibliography

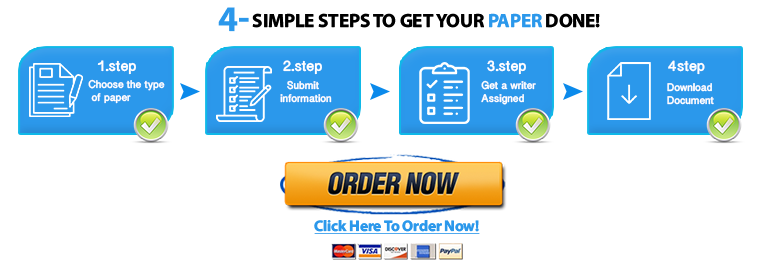

Module 02 Written Assignment – Outline and Annotated Bibliography This is the week you turn in your outline and annotated bibliography to give direction to your paper (Review the assignment in Module

01.) Outline: • • Provide a strong thesis statement outlines the path that your project will follow. Remember to reflect on an argumentative point of view (through an assumption or myth) Outline should support thesis, listing topics and sub-topics for your project. Annotated Bibliography: a. Annotated paragraphs for at least 3 sources include summary of the source, an evaluation, and description of source’s usefulness.

b. Properly formatted using APA guidelines. c. Mechanics follow required standards. Recap of Project Goal: • Write an argumentative research paper on a managed care-related topic, assumption or myth; thoroughly explaining what it is, why it’s important, and how it fundamentally impacts the managed care system today. You will gather evidence on present a well-reasoned argument or debatable issue. The goal of an argumentative paper is to show that your perspective is valid. You are to form reasons, draw conclusions and apply them to your findings. The purpose is not to completely prove your point, but to convince readers, with your evidence, that your argument or position has merit. Submit your completed assignment to the drop box below. Please check the Course Calendar for specific due dates. Save your assignment as a Microsoft Word document. (Mac users, please remember to append the “.docx” extension to the filename.) The name of the file should be your first initial and last name, followed by an underscore and the name of the assignment, and an underscore and the date. An example is shown below: Jstudent_exampleproblem_101504 Need Help? Click here for complete drop box instructions. Physicians and Non-Physician Providers Module 02 – Physician Services Overview Did you know that in most cases health plans do not pay a charge as it is billed by the physician? Instead, the health plan uses one of several approaches to determine an appropriate fee for a specific type of procedure. In most cases, the determined amount is less than the amount billed by the physician! This week you study the different methods of compensation used by health plans to reimburse physicians in managed care plans. You also discuss the difference between primary care, specialist care, and nonphysician providers. As Kongstvedt states in the textbook, “The backbone of any managed health care plan is the physician network.” Thus, it is important that you gain an understanding of the role that physicians and non-physicians play in the managed care system. Your Managed Health Care Project will also be introduced this week! This project provides you with an opportunity to thoroughly research a current issue, technology, or other concept dealing with managed care. You will become an “expert” on the aspect of managed care you pick to review. Physician and Non-Physician Providers Most managed care organizations divide the physician network into primary care physicians (PCPs) and specialty care physicians (SCPs). It is important that you recognize the distinction between PCPs and SCPs because of how specialty services are authorized and paid for. Primary Care Physicians (PCPs) • • PCPs include those physicians in the specialty of family practice, internal medicine, and pediatrics. Traditional HMOs require patients to see a PCP prior to seeking services from a specialist. The PCP acts as a gatekeeper and must authorize any visits to a specialist. (In contrast, in HMOs that provide for open access, patients can seek services from a specialist without authorization. Specialty Care Physicians (SCPs) • SCPs are those physicians who are not PCPs. All of the surgical specialties – pathology, radiology, anesthesia, neurology – are all examples of SCPs. Think about this: If you currently have health insurance, does your plan require you to see a PCP prior to seeking services from a specialist? What do you see as the advantages and disadvantages of a system where you must first see a PCP before seeking services from a specialist? Non-Physician Providers Non-physician or midlevel clinicians (NPC) include physician assistants (PAs) and nurse practitioners (NPs). The use of NPCs in health care is widespread. Peter R. Kongstvedt (2007) refers to a study that reported “an increase in the proportion of patients who saw NPCs from 30.6% to 36.1%.” NPCs are a great asset to managed care organizations. NPCs can provide primary care to patients, and they are also sometimes used to manage the care of chronically ill patients such as those with asthma or diabetes. Following are types of contracting situations that a managed care organization may have to deal with. Possible Contracting Situations • • • • • • • Individual physicians Medical groups Independent practice associations Specialty management companies Integrated delivery systems Faculty practice plans Retail health clinics Credentialing Proper credentialing must be performed to protect the managed care organization from possible litigation. Credentialing is usually carried out during the recruitment process and includes significant background checks regarding issues such as prior claims, training, and status according to national databanks. In most managed care organizations, the medical director holds the ultimate responsibility for credentialing along with a credentialing committee. However, most of the credentialing activities are usually carried out by the provider relations department. Three broad activities are involved with this process: • • • Data collection Verification Review and decision In the past, the managed care organization was required to conduct primary source verification; today a CVO, or credentials verification organization, may be used to conduct much of the data collection and verification on behalf of the managed care organization. Think about this: What are the pros and cons of using a CVO to perform credentialing activities? Compensation Models and Fees, Pay-for-Performance At the most basic level, there are two ways to compensate open panel physicians for services: • • Capitation Fee-for-service (FFS) However, as you will see, there are many possible variations of these two systems. Other than HMOs, all other types of managed care organizations use Fee for Service (FFS) or one of its variations. HMOs primarily use capitation, but also use a variety of other reimbursement methods as well. Capitation Capitation is prepayment for services on a per-member per-month (PMPM) basis. A physician is paid the same amount regardless of how many members receive services in a given month or how expensive those services are. The capitation payment does not vary based on the use of services by members. Capitation rates can vary depending on such factors as age, gender, current health status, geography, and practice type. Example: • • • If a physician receives $100 per month per member and the plan has 20 members, then the physician will receive $2000/month. Even if no members seek services in a given month, the physician is still compensated $2000. On the other hand, if all 20 members seek services in a given month, the physician is still only paid $2000. Think about this: Why would a managed care plan want to use capitation; what are the benefits of this type of reimbursement system? What are the drawbacks to capitation? Fee-for-service Fee-for-service (FFS) plans distribute payment on the basis of expenditure of resources. There are two categories of FFS: charge-based and resource-based. However, these two categories are described as straight FFS or performance-based FFS. Hospitals and Reimbursement Methods Developing a hospital network is a complex process. The process can be viewed from one of two perspectives: new network development and renegotiation with existing network participants. It is crucial that managed care organizations have adequate hospital coverage in their service area. In general, access to a hospital should be within a 30-minute drive time, with allowances for such things as residing in a rural area. Six basic steps are involved in developing a hospital network as follows: Steps in Developing a Hospital Network • • • • • • Selecting hospitals Establishing general negotiating strategy Developing data Setting goals Determining the responsibilities and roles of plan management Determining the responsibilities and roles of hospital management There are a number of different reimbursement methods available in contracting with hospitals, except in those rare states where regulations diminish or prohibit creativity. The methods most widely used by plans include the following: capitation, per diems, diagnostic-related groups (DRGs), and fee schedules. Capitation This method reimburses the hospital on a per member per month (PMPM) basis to cover all institutional costs for the plan’s members; it is used primarily by HMOs, though other plan types might also choose to use it; capitation payments may vary by age and sex but do not fluctuate with premium revenue. Per diem A common method of per diem is straight per diem; this method is a negotiated single charge for a day in the hospital regardless of any actual charges or costs incurred; for example, a plan may pay $800 for each day; whether the actual cost of services is more or less, the hospital receives $800. DRGs DRGs (diagnostic-related groups) are used by Medicare as well as other commercial health plans; standardized codes used by hospitals for billing are put through a “grouper” which assigns the appropriate DRG based on the average use of resources for similar cases; the payment for each DRG is fixed prospectively; only in rare situations is additional payment made for complicated or expensive cases that greatly exceed the DRG payment; in most instances, the DRG payment is fixed and not adjusted. Fee schedules In this method, the hospital and health plan agree, or contract, to a fee or discount percentage for services; in the case of a discount percentage, the hospital submits its claim in full and the health plan discounts it by the contracted percentage and then pays it; the hospital must accept this as payment in full and cannot balance bill the patient. Pay-For-Performance Pay-for-performance (P4P) is a hot topic in managed care today. It is important to have a basic understanding of what this is all about. P4P involves offering performance-based incentives to providers. Most of these incentives are financial. In most situations, providers have the option whether or not to participate in P4P programs though involuntary participation is possible. The definition for Pay-For-Performance was developed at a P4P Designs Principles conference in 2004. The definition states, “The use of incentives to encourage and reinforce the delivery of evidence-based practices and heath care system transformation that promote better outcomes as efficiently as possible.” P4P applies to both physicians and hospitals. What are the basic elements of a P4P program? Since different P4P programs set up by different health plans have very little in common, what follows is that most commonly used by hospitals and physicians today. The basic elements in aP4P program are listed and described below. Basic Elements of P4P Programs Measures A variety of measures can be used; measures may be simple or complex; it is recommended that measures be straightforward, understandable, and valid; measures can be created by the managed care organization or obtained from nationally recognized programs; in most cases, a mix of both sources is used. Data The data collected must also be valid, reliable, and consistent; the process used to collect the data should ensure that data is easy to collect and report; typical sources for data used in P4P include the following: medical claims, pharmacy claims, laboratory results, medical record audits, and patient surveys. Rewards How measurements are used to reward providers varies from managed care organization to managed care organization; it is also different for hospitals than it is for physicians; examples of rewards include the following: tiering, reimbursement adjustments, and bonus payments.